You plan your week, you plan vacations, you might even plan your dog’s birthday party, but do you plan for your financial future?

Whether you do or not, and either or is totally fine, you can benefit from the full experience of financial planning.

What is Financial Planning?

The first and most important thing to know about financial planning is that it is for everyone. You don’t have to be rich already to plan for your financial future.

So what is it? Basically, financial planning is a seven-step process that helps you set and achieve your financial goals, which in turn can help you meet your life goals.

The financial planning process is used by professionals in the financial services industry such as Certified Financial Planners (CFP), Registered Investment Advisor (RIA) and Certified Public Accountants (CPA). Please note that all these professionals are held under the fiduciary standard, which means that must always act in the best interest of their clients. This is something to keep in mind when you are looking to hire a financial planning professional.

So, basically you first decide it’s time to plan your financial future (yay, kudos to you) then you hire a financial planning professional you feel comfortable with (remember the fiduciary standard means your interests come first), and together you both go through the 7-step financial planning process.

The 7 Steps

- Step 1 – Understand where you stand financially

- Step 2 – Identify your goals

*The next steps are mostly for the financial planner to accomplish

- Step 3 – Analyze what courses of actions you are currently taking and what actions you could possible take

- Step 4 – Create financial planning recommendations based on the analysis

- Step 5 – Present those recommendations to you

*The final steps are where the real work begins

- Step 6 – Implement the recommendations that you both agree on

- Step 7 – Your financial planner will monitor and update you on how you are doing and help you stay on track

Financial Areas That Are Covered

You might think that financial planning entails budgeting and creating a spending plan but it is so much more than that. There are several topics you and your financial professional will explore to ensure you are prepared in all financial aspects.

Financial topics that are included in the financial planning process include:

- Financial statement

- Insurance and risk management

- Employee benefits

- Investments

- Income tax planning

- Retirement planning

- Estate planning

- Special needs planning

Ensuring that you are covered in all these financial topics will help you maximize your potential for meeting your financial and life goals. Hopefully, you can start to see why financial professionals like CFPs might be considered “expensive” to work

Real World Numbers

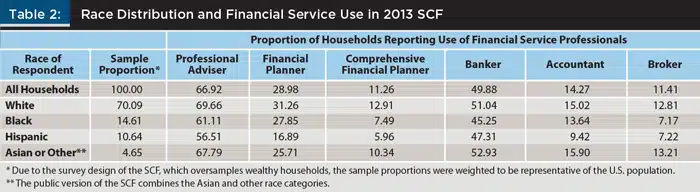

As a future Certified Financial Planner (CFP), one of my main goals will be to help those who are underserved when it comes to financial services. And as you can see from the table above, provided by a study published on the Financial Planning Association’s website, the Hispanic community is the least likely to seek out the assistance of a financial planner. I would like to change that.

Everyone can and should be able to benefit from financial planning services. We all deserve a piece of the pie because let me tell you it’s a enormous pie (more on that in another post).

Signs You’re Ready to Start

Now that you have an idea of what financial planning is and what to expect, it is time to ask yourself “am I ready?” Here are some signs that you might be ready to hire a financial professional to help you plan your financial future and check some boxes off your bucket list.

- Feeling overwhelmed with your financial situation

- Lack of time and expertise to manage your finances yourself

- Expecting or going through a big life transition

- You have a complex financial situation

- Want to start planning for the long-term

- Interested in ways to optimize your finances

Ultimately, hiring a financial planner is a personal decision that depends on your individual circumstances, goals and preferences. However, if you identify with one or more of the signs listed above, it may be an indication that you are ready to seek the professional help of a financial planner.